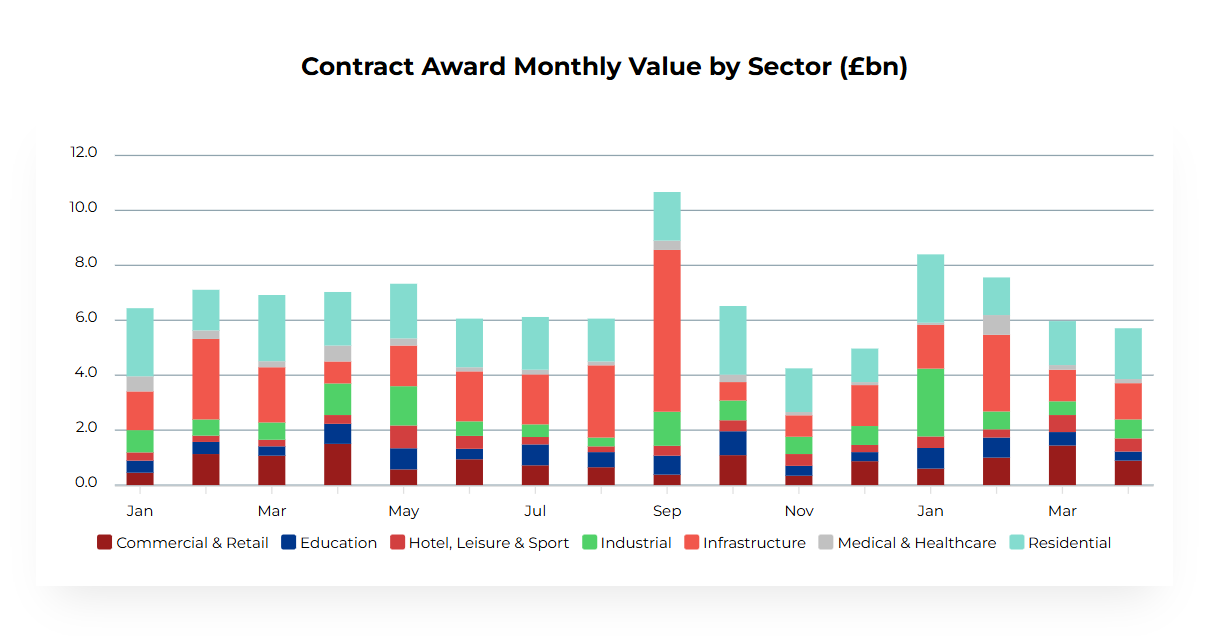

Construction contract awards are now almost £1 billion below the 2024 average at £5.7 billion, according to consultancy Barbour ABI.

Contract awards have declined over the past two months with April value down 19% compared to the same period last year, following a positive start to the year.

There are signs of resilience and optimism in some areas, however. Infrastructure stood out as a relative bright spot, increasing 14% between March and April, with an increasing volume of brick and concrete deliveries, and a growing pipeline of green energy projects.

Infrastructure planning approvals were up 85% on March and 150% on the 2024 average, with green energy projects, with the Rampion offshore windfarm and Moy Lodge hydro-energy storage facility in Scotland leading the way.

Ed Griffiths, Barbour ABI’s Head of Business and Client Analytics, explained: “The Royal Institution of Chartered Surveyors (RICS) has forecast that infrastructure will be the main driver of industry growth in the coming years.

“Adding momentum to the infrastructure and planning outlook, the Chancellor has pledged to reform environmental regulations that supposedly unnecessarily hinder development.”

Residential awards were also up month on month. However, the three largest projects (totalling £726 million) were student accommodation developments in the North of England and Scotland, which do not contribute to the government’s 1.5 million homes housing target.

Regionally, Wales had an optimistic month almost doubling the 2024 average for contract awards. However, over two-thirds of this value came from the £225 million Cardiff Bay music arena and hotel development. Contract value for the North West increased by 86% to £1 billion, 60% above the 2024 average.

The overall value of new planning applications dipped from February falling 14% to £8.5 billion in March.

“Despite some positive indicators, including increased materials deliveries and infrastructure momentum, job cuts across the sector and uncertainty driven by external pressures, such as US tariffs, suggest that the near-term outlook remains challenging. Notably, new home starts in London are at a sixteen-year low according to the latest industry figures,” Griffiths concluded.