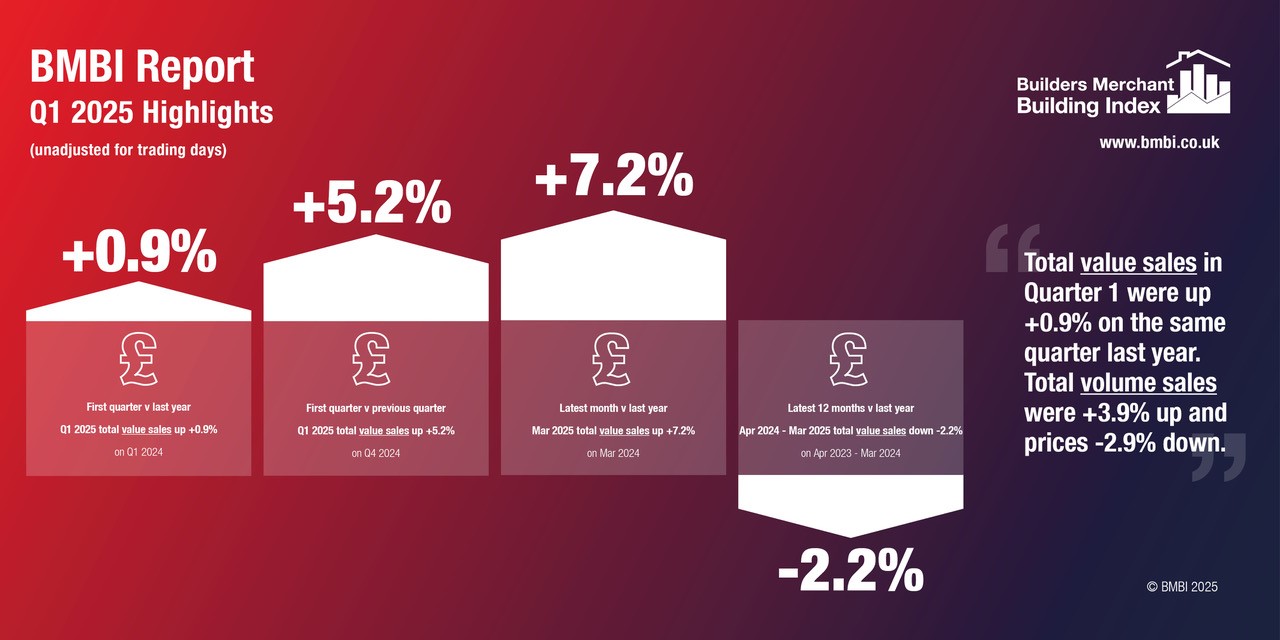

Sales at builders' merchants have shown a positive start to the year, with figures released in the latest BMF Builders Merchants Building Index (BMBI) confirming the first comparative quarterly growth in over two years. This is largely due to a significant upturn in March, which saw value sales increase by +7.2% compared to the same month last year.

Looking at the first quarter as a whole, year-on-year total value sales in Q1 2025 grew by +0.9% on the same period in 2024. Total volume sales increased by +3.9%, while prices fell -2.9%.

Sales increased in eight of 12 product categories. This included a strong performance by the largest category, Heavy Building Materials, led by Blocks and Aggregates followed by Bricks and Roofing tiles, which saw value growth of +2.0%, volume growth of +5.8% and a price decline of -3.6%. Other categories outperforming the total market for value growth included Services (+5.3%), Tools (+2.9%) and Landscaping (+2.6%).

However, total value sales for Timber & Joinery Products, the second largest category, underperformed the overall market, with Q1 2025 sales value down -1.4% against Q1 2024. Volume increased by +2.9%, with price down by -4.2%, with Sheet Materials the main driver behind this decline.

Workwear and Safetywear (-3.3%), Decorating (-3.2%) and Kitchens & Bathrooms (-2.7%) were the other categories experiencing year-on-year value decline against Q1 2024.

A comparison of value growth in Q1 2025 with Q4 2024 shows total value sales in the latest three months were +5.2% higher than in the previous three months. Total volume sales increased by +5.8%, and prices were down by -0.5%.

Eleven of the 12 categories sold more, led by the seasonal category of Landscaping, where value sales increased by +14.1%. Workwear & Safetywear (-0.8%) was the weakest category.

With two more trading days in Q1 2025, like-for-like value sales were +1.9% higher than the previous quarter.

Total value sales in the 12 months April 2024 to March 2025 were -2.2% lower than the previous period. Total volume sales were -1.4% down, with prices down -0.8%. With four more trading days in 2024, like-for-like value sales were -3.8% lower.

Value sales increased in five of 12 categories, led by Tools (+7.2%), Workwear & Safetywear (+6.6%) and Services (+4.3%). Conversely, value sales in Timber & Joinery Products (-4.2%), Kitchens & Bathrooms (-2.9%) and Heavy Building Materials (-2.8%) were weaker than the Total Merchants figure.

Emile van der Ryst, Key Account Manager – Trade & DIY at NiQ GfK, said: "The Builders Merchants channel has made a strong start to 2025, taking into account previous years and the various macroeconomic and political concerns, both locally and globally.

"However, this position may be short-lived, as general expectations for the sector have become more negative compared to views at the beginning of the year. The second quarter results will be shaped by the autumn budget and the realities surrounding it, while the US-China trade war adds another significant layer to ongoing global uncertainty, which may affect merchanting sales.”

John Newcomb, CEO of the BMF, said: “A positive view of the first quarter of 2025 may suggest a market poised on the brink of an upturn, yet the outcome for the rest of the year remains uncertain. While we would like to remain optimistic that the brighter picture emerging in March will continue, much will depend on the return of consumer confidence; with inflation rising again, this may take some time. It is proving a difficult year to forecast with any accuracy.”