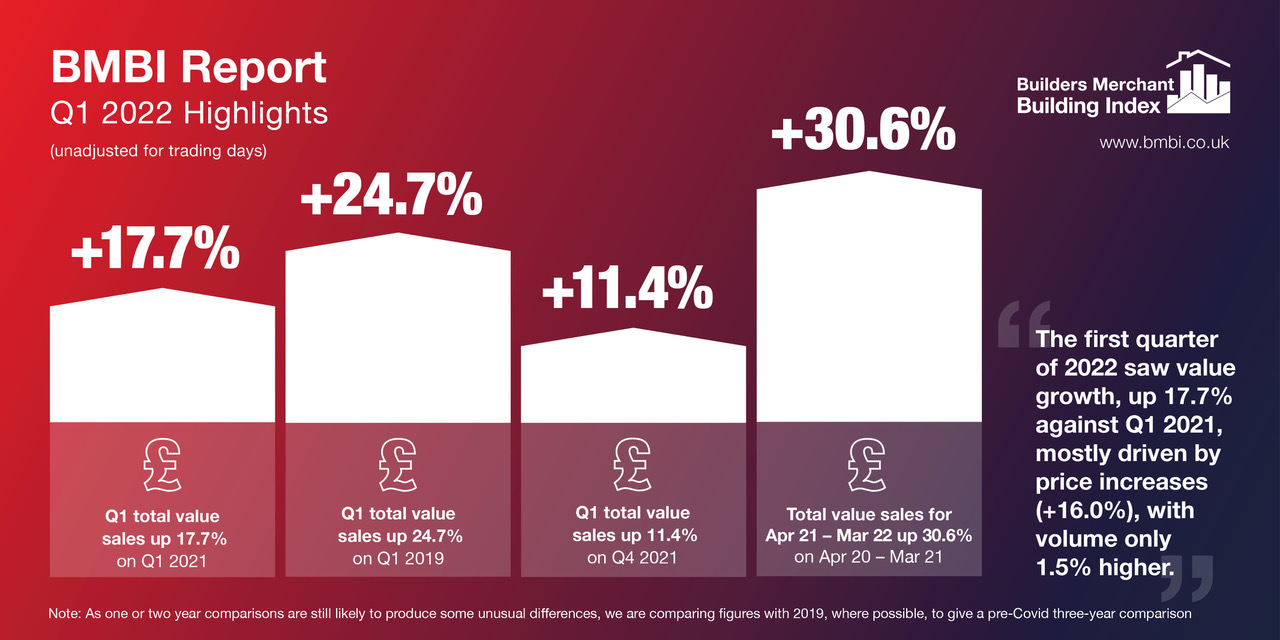

The BMF’s Builder Merchants Building Index (BMBI) latest report on sales of building materials in the UK, underscores the growing impact of price inflation on the sector.

The value of sales in the first quarter of 2022 was up by 17.7% against Q1 2021. However, as general inflation in the UK has been revealed to have jumped by another 2% to 9%, almost all of this was driven by price increases with volume rising by just 1.5%.

While the figures indicate a continuing demand for building materials, they also confirm price inflation as a critical issue, with the impact of rising energy, fuel and raw material costs on product price clear to see.

Drilling down to year-on-year performance comparisons for the three largest product categories, the top one, Heavy Building Materials, increased 17.4% by value, but 5.0% by volume. This category includes many energy-intensive products, and bricks, blocks, cement, plasterboard and roofing products all saw their highest quarterly prices to date.

Timber & Joinery products have been even more affected by fluctuating prices over the past 12 months. Year on year results show sales value up by 21.4%, with volume down by 11.3%, a price increase of 36.9% over Q1 2021.

However, this is tempered by the fact that, in Q1 2022, Timber & Joinery prices decreased by 6.7% against Q4 2021, which may indicate that prices in this category have already peaked.

Landscaping, one of the strongest performers throughout the pandemic, saw a value increase of 14.4% against Q1 2021, while volumes are down by 3.5%.

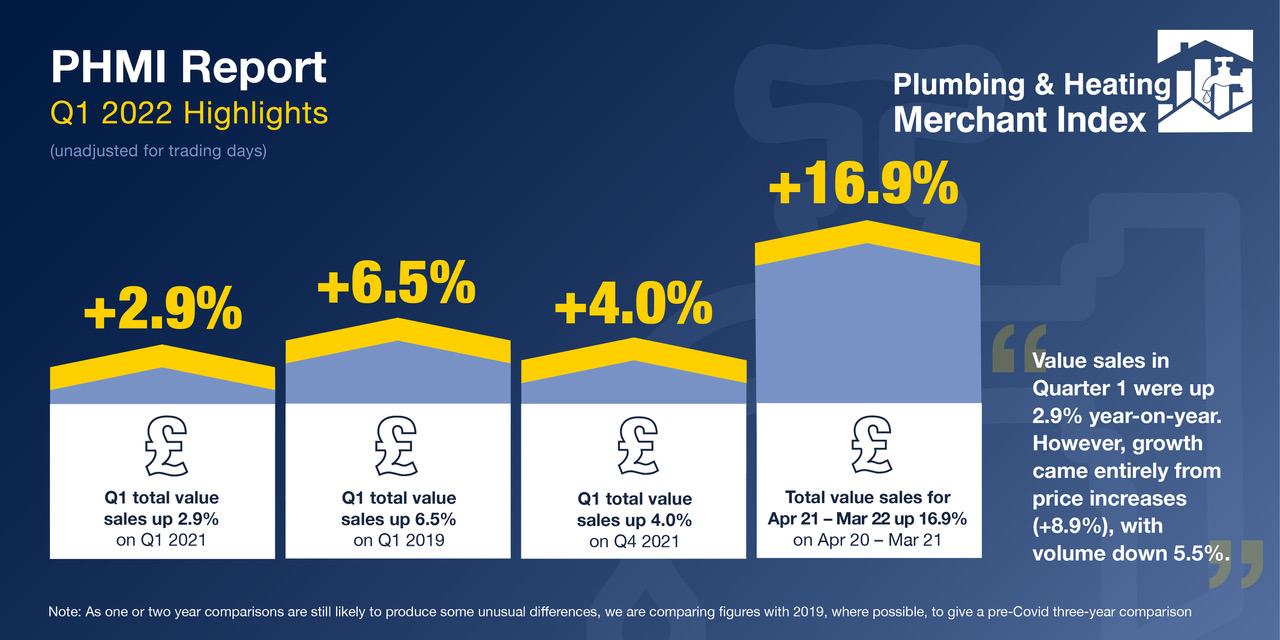

A similar state of affairs is noticeable in figures released from latest Plumbing & Heating Merchants Index (PHMI), which show that sales values of pluming and heating products increased by +2.9% in Q1 2022 compared to Q1 2021. However, with sales volumes this year down by -5.5% on the same period last year, any growth is entirely the result of price inflation (+8.9%).

Comparing the first quarter of 2022 with Q4 2021, and removing trading day differences between the two periods, Q1 sales were down by 0.9%.

The P&H sector continues to be adversely affected by availability issues for certain key products, in particular gas boilers, where supply has been delayed by the global shortage of semi-conductors.

The data for the PHMI is taken solely from P&H specialists, including City Plumbing Supplies, Graham, James Hargreaves Plumbing Deport, PTS and Wolseley, who form part of GfK’s Plumbing & Heating Merchants Panel, and there is no overlap or double counting between the PHMI and the BMF’s established Builders Merchants Building Index which analyses sales at generalist merchants.

John Newcomb, CEO of the Builders Merchants Federation said: “Taken at first sight there are some astonishing value growth figures in this quarter’s BMBI, but this must be tempered by the disparity between price and volume growth.

“The supply chain was already facing uncertainty before the outbreak of war in Ukraine. The conflict can only exacerbate this. Continuing pressure on availability coupled with rising costs for raw materials, energy and labour suggests that price inflation will be the main story of 2022.”

Emile van der Ryst, Senior Client Insight Manager – Trade at GfK, added: “Growth forecasts have been revised down across the world since Russia invaded Ukraine at the end of February.

“At this stage it is difficult to make any sensible prediction, but there’s an expectation that market conditions will become increasingly more difficult as prices continue to rise and consumer spend is stretched further and further.”