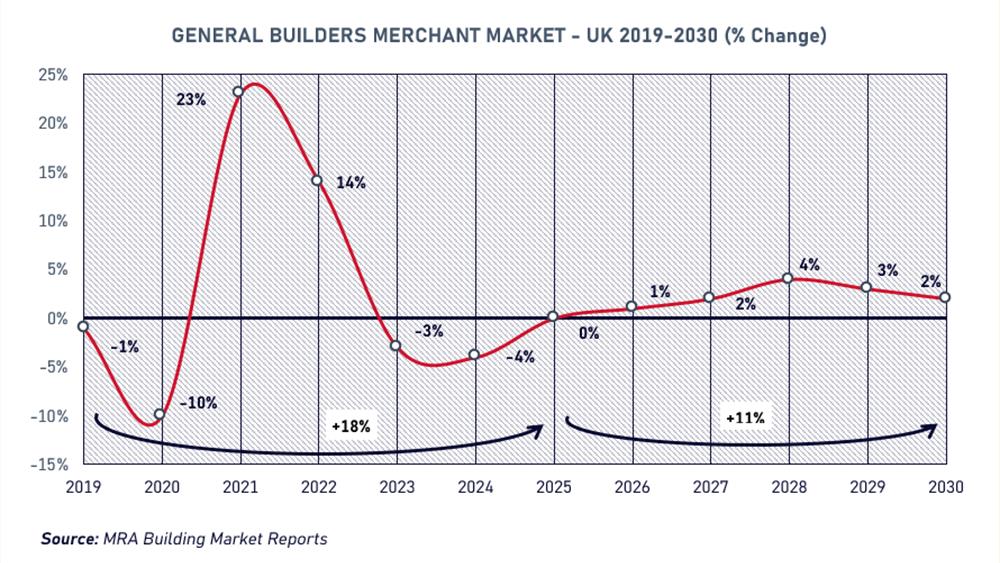

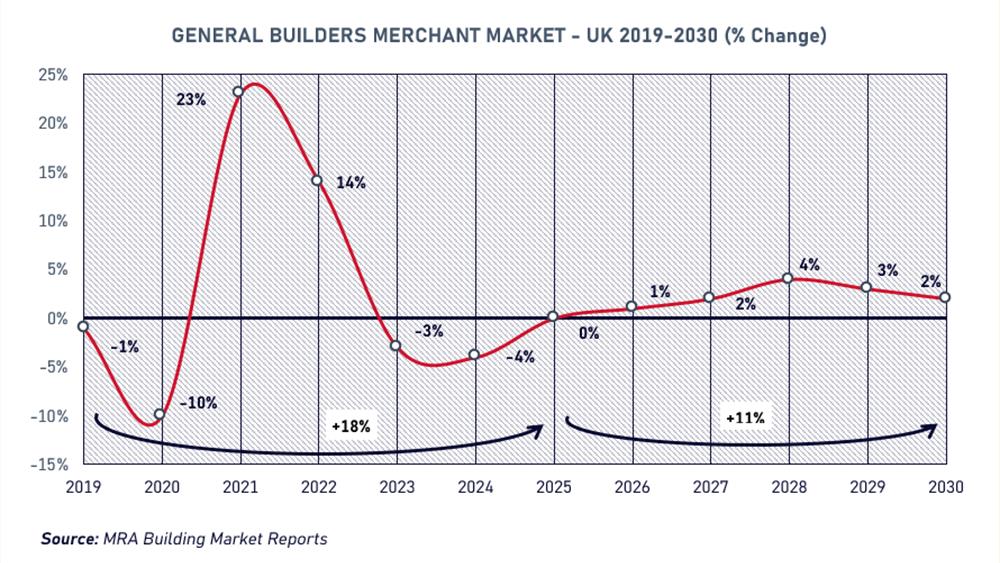

MRA Reports predicts that future growth is expected to be slow and gradual between 2026 and 2030.

According to a new report by MRA Building Market Reports (MRA Reports), future growth in the general builders’ merchant market is expected to be slow and gradual between 2026 and 2030. MRA forecasts value growth of 11% over the period. Since 2019, the market has seen growth of 18% in value terms, though volume sales have declined.

The new report quantifies the general builders’ merchants’ market, excluding plumbing & heating merchants and other specialist segments within building products distribution. It provides a granular review of the market, combining findings from a series of quarterly surveys tracking builders’ merchants’ sales expectations and confidence with in-depth research and data analysis.

Over the past three years, economic and geopolitical uncertainty along with a change of government and price volatility has led to subdued levels of construction and housebuilding activity. This in turn has led to a difficult trading climate for builders’ merchants, though the recent decline in market size, and prices, can be partly attributed to an adjustment from unsustainable levels during the post- Covid lockdown period.

In terms of supply structure, the leading groups in the general builders’ merchants’ market are Stark Group, Travis Perkins, MKM, Huws Gray, Kingfisher and Grafton Group. Together the six largest players, within our definition, are estimated to account for just over 50% in terms of revenue.

The market has become more competitive since 2022/23, particularly for lightside products. The growth of online specialists, online marketplaces and fixed price operators with large branch networks do present a threat to general builders’ merchants.

The report reveals that many merchants are struggling financially. A detailed analysis of profitability among general builders’ merchant businesses shows that overall, average profit margins fell sharply during 2023 and 2024, with almost a quarter of businesses reporting a loss in 2024. Larger groups and National operators performed particularly badly, and this could lead to further changes to the market structure during 2026.

Forecasts for the market though are relatively optimistic. Unless another major disruptive global event occurs, MRA expects construction activity, general confidence levels and merchants’ sales to pick up towards the second half of 2026/early 2027. There is a significant latent demand in many sectors, such as housing, offices and infrastructure, with many projects waiting to go ahead. Merchants will need to stay focused on what their customers want from them, rather than what customers are buying in other channels, while improving their resilience in the event of future supply chain disruption.

Primary research forms an important part of the research process. Results from MRA’s most recent survey of general builders’ merchants showed that merchants’ confidence in the market remains weak. When asked, only 21% of merchants were more confident in the market than at the same time the previous year, and the most common reason cited for increased confidence was the belief that conditions ‘cannot get any worse’ and that the wider economy will have to improve. Reasons for being less confident included ongoing economic uncertainty, government policy, subdued demand and competitive pressures.

Anna Eriksson, of MRA Reports said: “The builders’ merchant supply chain is complex and highly fragmented. Market sizes, growth rates and trends look very different depending on how the market is defined and measured. We identified a need for an independently researched, more granular review of each of the channels and product sectors within the building products distribution market.

“This report focuses specifically on the general builders’ merchant segment and is underpinned by robust primary research as well as rigorous desk research and data analysis. Our quarterly Builders’ Merchants Pulse Survey includes open questions and delivers real depth and insight into market conditions and sentiment, providing an up-to-date view of the state of the market and its challenges.

MRA Reports was set up last year by two leading researchers in building markets intelligence, Anna Eriksson and Mike Rigby, to provide companies in the building materials supply chain, advisors and investors with a better understanding of the rapidly changing structure and dynamics of building product supply chains.