The downturn in construction activity has intensified, according to the latest Construction PMI report, as firms see renewed decline in housing projects. As a result year-ahead expectations remain subdued.

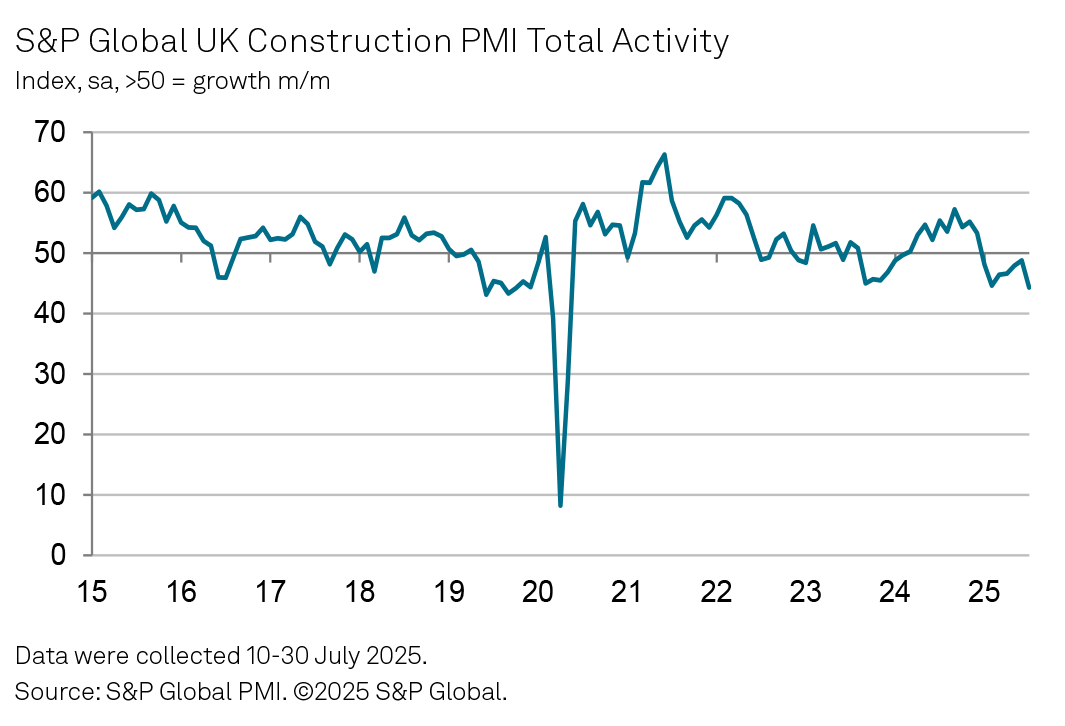

There was a considerable slump in the UK construction sector at the start of the third quarter, according to the latest S&P Global PMI survey data, with total industry activity levels falling at the steepest pace since May 2020.

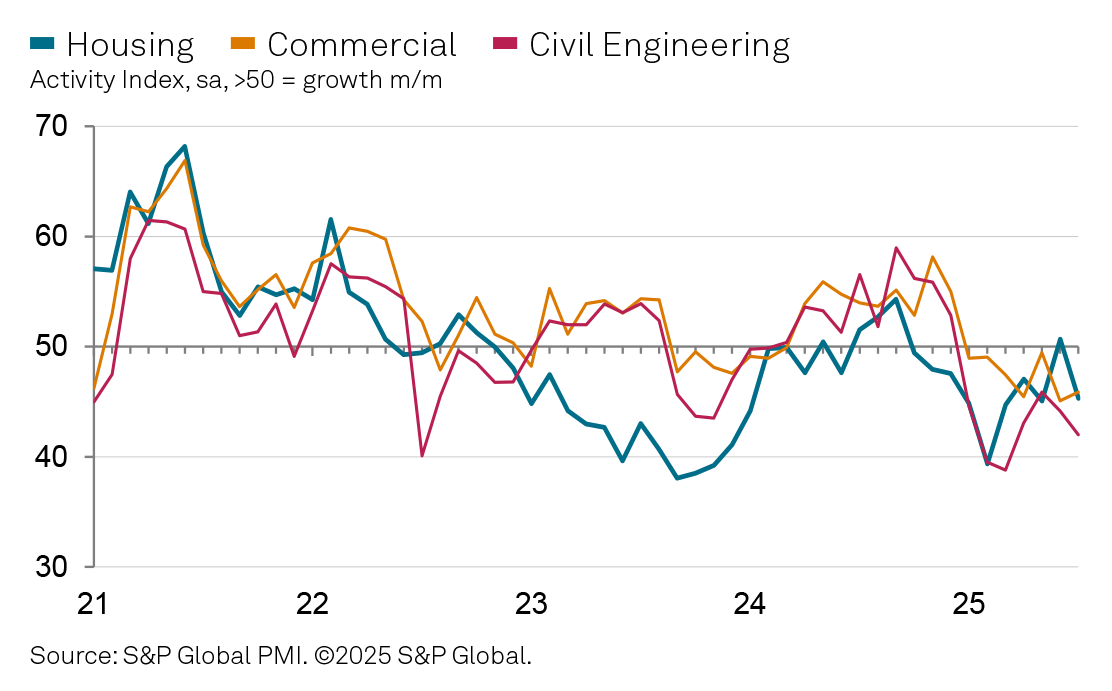

Underlying data highlighted marked decreases in volumes of work carried out across all three monitored sub-sectors, but a considerable drag came from a fresh drop in residential building.

Posting 44.3 in July, down from 48.8 in June, the headline S&P Global UK Construction Purchasing Managers’ Index – a seasonally adjusted index tracking changes in total industry activity – signalled the sharpest contraction in over five years at the start of the third quarter.

Where a reduction in activity was reported (around 29% of the survey panel), firms mentioned site delays, lower volumes of incoming new business, and weaker customer confidence as reasons for the downturn. Some respondents also cited lower work undertaken on public sector projects.

Notably, of the three monitored types of construction work, civil engineering saw the sharpest drop during July. The headline PMI was also pulled lower by a renewed decline in residential building activity. As for commercial construction, a marked but softer fall was also registered.

UK constructors remained challenged by subdued demand conditions. The volume of new incoming work declined for a seventh month running in July, with the pace of contraction at its most pronounced since February. A drop in tender opportunities was cited by panellists.

Looking ahead to the next 12 months, surveyed companies were optimistic of growth in activity on balance, but expectations were weak when compared with their long-run trend. This was despite business confidence ticking up slightly from June's two-and-a-half-year low. Concerns surrounding the broader economic outlook weighed on company growth projections.

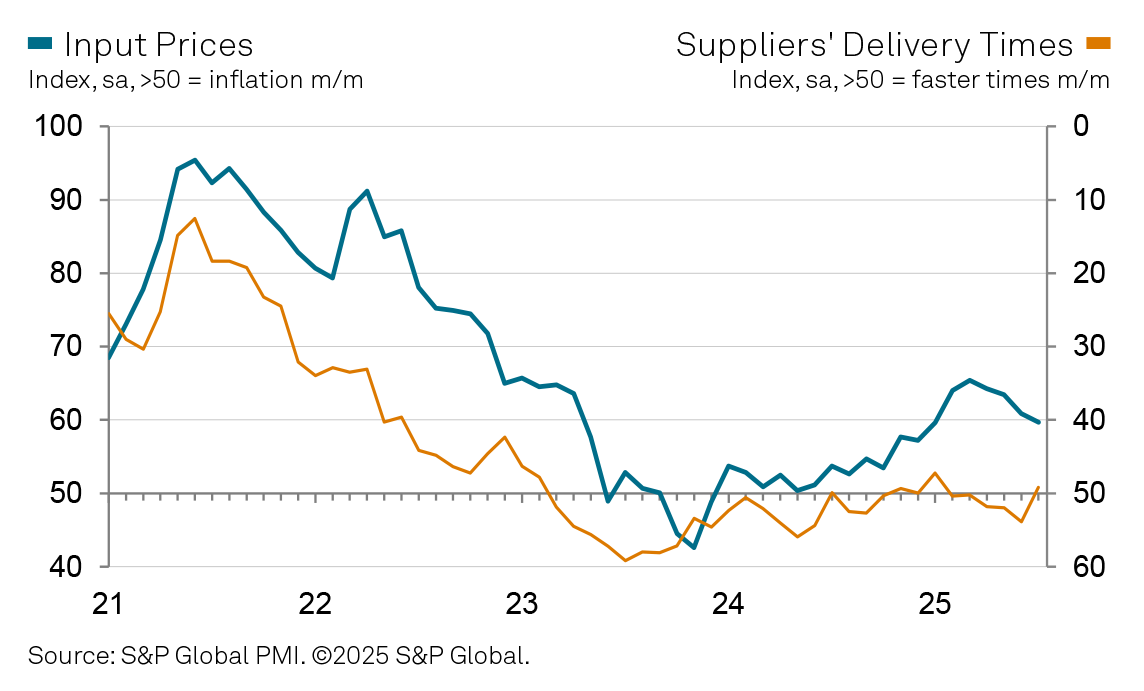

The volume of construction materials purchased by surveyed firms declined in July, although the fall was the softest seen since the start of 2025. When it came to the receipt of purchases, the latest PMI data revealed delays from vendors. This marked the first time in six months that delivery times have lengthened.

That said, UK constructors reported higher charges from their suppliers at the start of the third quarter. This underpinned a sharp monthly rise in their operating expenses. However, the overall rate of inflation was the weakest since January.

The downward trend in payroll numbers continued into July, extending the current period of falling employment to seven months. Lay-offs, recruitment freezes and the nonreplacement of leavers were seen in panellists' anecdotal replies to the questionnaire. UK constructors also pared back their usage of subcontractors, but their rates charged nevertheless rose at a sharp pace, in line with the trend seen since late last year.

Joe Hayes, Principal Economist at S&P Global Market Intelligence, said: "Having trended upwards in recent months, our survey data for July signal a fresh setback for the UK construction sector, with total industry activity falling at the sharpest rate since May 2020. Dissecting the latest contraction, we can see a fresh and sharp drop in residential building, as well as an accelerated fall in work carried out on civil engineering projects.

"Forward-looking indicators from the survey imply that UK constructors are preparing for challenging times ahead. They're buying less materials and reducing the number of workers on the payroll. Expectations also continue to underwhelm, despite a modest pick-up in confidence from June's two-and-a-half-year low.

"Anecdotally, companies reported a lack of tender opportunities and a hesitancy from customers to commit to projects. Broader themes of uncertainty, both domestically but also internationally, will do little to reignite investment appetites."