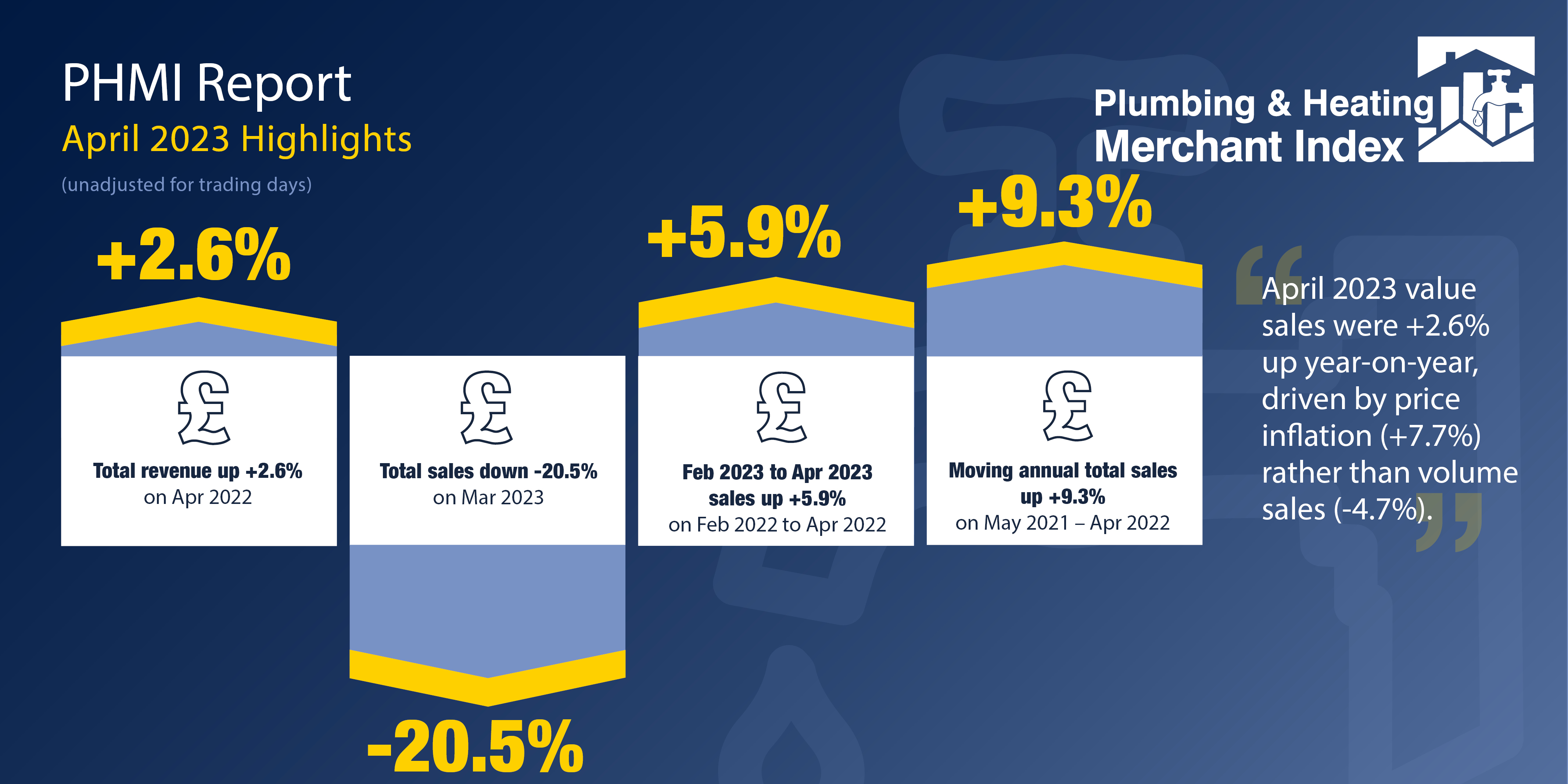

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for April 2023 through specialist plumbing and heating merchants were +2.6% up on April last year.

However, this growth was driven by rising prices (+7.7%) as volumes slumped -4.7%.

With one less trading day in April 2023, like-for-like value sales were +8.3% up compared to April 2022.

Month-on-month, April value sales were -20.5% lower than March. Volume dropped -19.1% with prices down by -1.7%. With five less trading days in April, like-for-like sales were +1.5% higher.

Total value sales over the last three months, February 2023 to April 2023, were +5.9% higher than the same period a year ago. Volume sales were down -2.1% while prices rose +8.2%. With one less trading day in the most recent three-month period, like-for-like sales were +7.7% higher.

Plumbing & Heating merchants’ value sales in the 12 months May 2022 to April 2023 were +9.3% higher than the previous twelve-month period (May 2021 to April 2022). Volumes were flat (-0.1%) but with marked price inflation of +9.4%. With two less trading days in the latest period, like-for-like sales were up +10.2%.

The PHMI index for April was 92.1. With three less trading days, the like-for-like index was 105.7.

Mike Rigby, CEO of MRA Research, which produces the report, says: “April sales volumes were down -4.7% on April last year, and down -19.1% on March this year as economic uncertainty, high inflation and rising interest rates continue to hit new housing and private housing RMI (repair, maintain and improve) work, particularly in the private sector.

“It’s worth remembering that the private housing new build and the private housing RMI sector together account for around 40% of total construction output, according to the Construction Products Association.

“There was some good news for homeowners in April – a hiatus in the Government’s planned raise to the Energy Price Guarantee – but this will do little to ease the pain of those struggling with tracker mortgages and the cost of living, which is fast outstripping earnings.

“However, GfK’s long-running Consumer Confidence Index improved three-points in May, the fourth monthly increase in a row from January’s low of -45. How people view their personal finances in the next 12 months also improved with a five-point jump to -8.

“This is an important measure as it underpins our ability to spend on the goods and services that drive the economy. It’s pointing in the right direction, but keeping our feet on the ground, the headline score of -27 means we’re still deep in negative territory and some way from recovery.”